Award-winning PDF software

2022 IRS 1096 Aurora Colorado: What You Should Know

The “Form 1099” section can then be marked as such by the Tax-exempt and Self-Employed Division. To obtain more information on filing Form 4070, Personal Income Tax Return — IRS If, after completing the Form 4070, you still have questions about processing the Form 4070, you may wish to contact the information office for tax reporting at the address below (in most areas in the United States) — You cannot submit an online tax return through an internet banking website like pay.com or skrill.com, however you can submit a paper return through direct deposit or a payroll company or financial institution. Your tax account statement may be sent to you in either paper or electronic format through the mail, or you can download and print an electronic tax account statement. Please note that not all tax accounts are equal and a Tax-exempt account may only be used for tax preparation. If you have questions about filing a Form 4005, please use the Tax-exempt and Self Employed Division phone number (). The following is an outline of some of the information that may be on your Form 4005. What is the purpose of the Form 4005? The purpose of the Form 4005 is for any taxpayer to report any changes in a taxpayer's financial situation that have a materially adverse effect on the taxpayer's ability to pay income tax. This includes, but is not limited to: · The loss or sale of a home. · Changes in the number of dependents. · Changes in the taxpayer's filing status. · Changes in tax withholding. What do I need to do with my Form 4005? · Your Form 4005 must be filed with the IRS within 180 days of the date on which you received the Form 4005. The Form 4005 needs to clearly describe the material changes to your financial situation described above for which you are filing. · Include a completed Form 4005 showing how the material changes reported occurred. · For each Form 4005 you file, you should receive a statement indicating how you should file it. The statement should contain a checklist containing the required items on the Form 4005, Form 4006, Form 4007, Form 4008, or Form 4009. · If you can't file your entire Form 4005, include a completed IRS Form 4005A with each Form 4005.

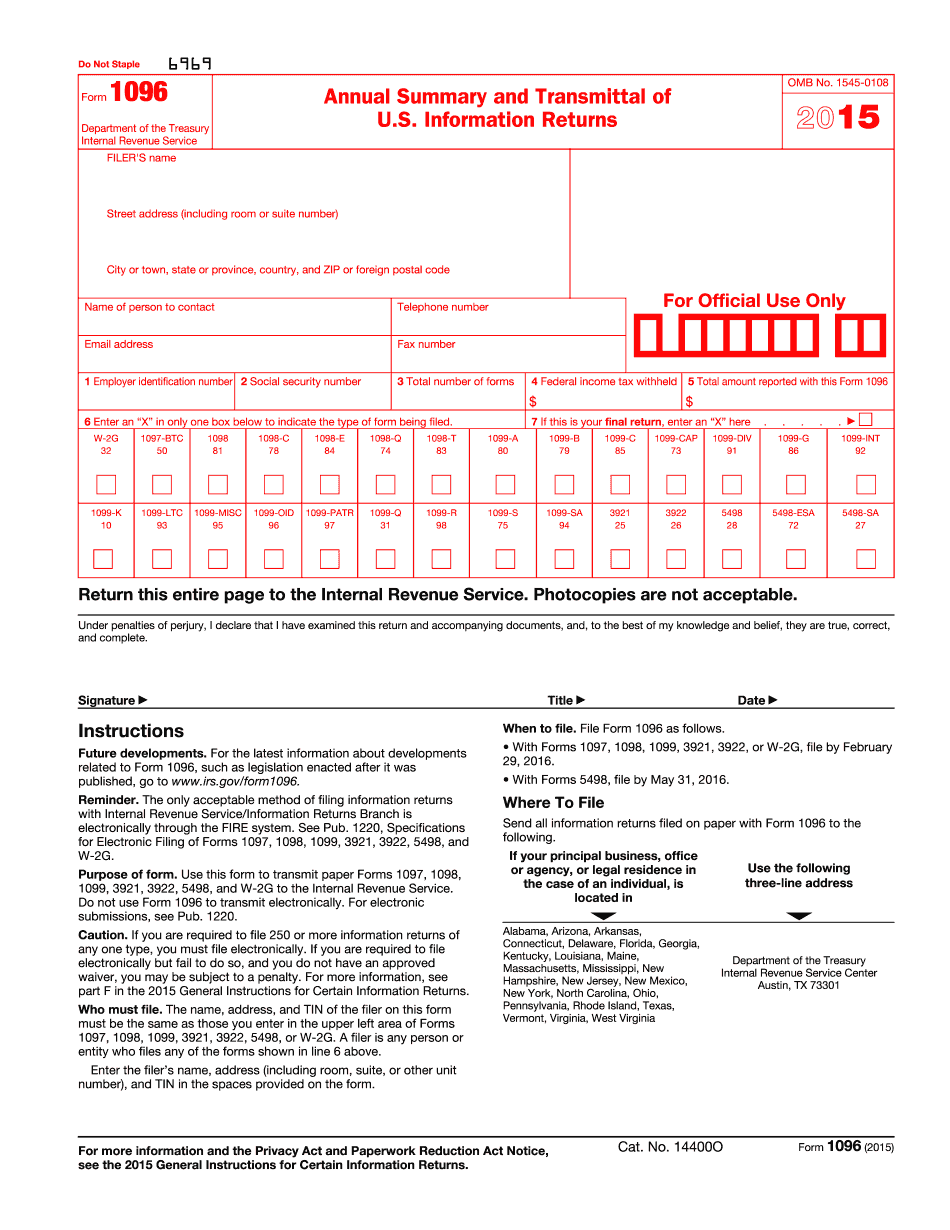

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete 2025 1096 Aurora Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a 2025 1096 Aurora Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your 2025 1096 Aurora Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your 2025 1096 Aurora Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.