Award-winning PDF software

2022 IRS 1096 for Santa Maria California: What You Should Know

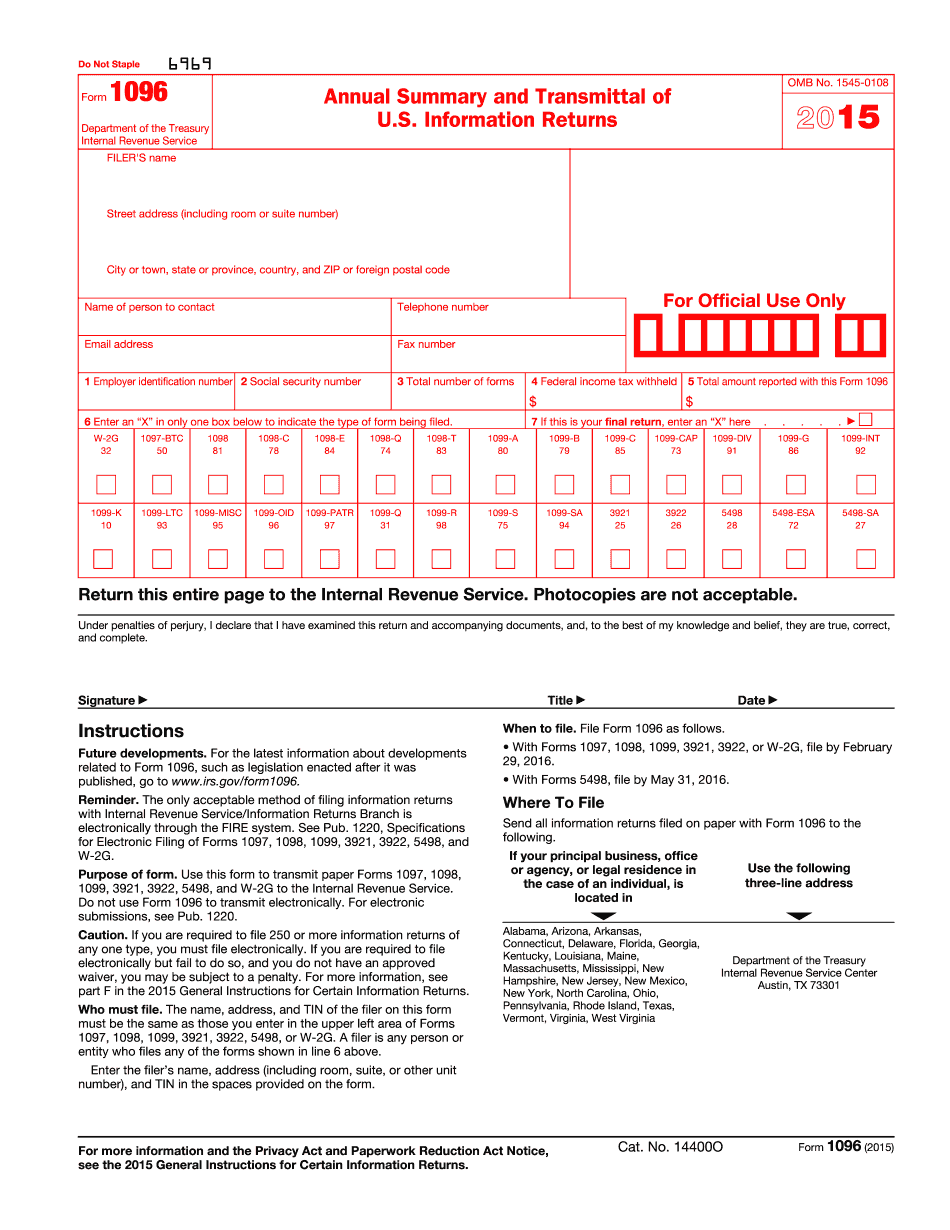

The Federal income tax code was enacted in 1913 with the passage of a Revenue Act. Since that time, the standard rate of income tax has risen and fallen depending upon the economy and the level of economic growth. In most years, the tax burden increases as income rises, and when a recession occurs, the average income tax rate decreases. The Federal Income Tax (Tax Code) defines seven federal tax brackets, each ranging from 10% to 37% for income-earners up to 110,800 and from 10% to 35% for income-earners above 110,800. The most common bracket is 25% for all income for tax year 2021, but there is an additional 14% bracket for income above 180,000. The top marginal rate for each type of income is 35%, and some are higher, for instance, 10% for wage income over 500,000. If you pay your taxes via paper or electronic form, your income and tax situation could change dramatically in just a few months. Before you fill out your form, be sure you know how much tax you owe and where to send your payments. Form 1096 contains a range of questions required in all IRS forms, but the answers are frequently different from the forms being received by individual taxpayers. For this reason, it's critical to note the information in your Form 1096. The most common questions on the Form 1096 are set out below. Do you have a home office? When you file the Form 1096, you'll be asked to provide information about what you use in your home office as evidence that the information is for the business. Include documents that show a permanent location for your place of business including documents (letters, invoices, business papers) showing the address and phone number of your home office. Examples of permanent locations include: phone books, filing cabinets, mailboxes, or any other permanent locations. Do you have any other business? When you file the Form 1096, you'll be asked to provide information about any other businesses you have. Include details about your other business' location, whether you use that location to conduct business, whether your other business has an office, warehouse or warehouse in the community in which you make your business. In addition, include details about the type of business: sole proprietor (as an individual) or partnership, C corporation (or limited liability company (LLC)), or S corporation (individual or group partnership).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete 2025 1096 for Santa Maria California, keep away from glitches and furnish it inside a timely method:

How to complete a 2025 1096 for Santa Maria California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your 2025 1096 for Santa Maria California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your 2025 1096 for Santa Maria California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.