Award-winning PDF software

Baton Rouge Louisiana online 2025 IRS 1096: What You Should Know

No. As part of the Louisiana Taxpayer Bill of Rights, enacted in 2013, Louisiana does not require the filing of Forms MISC. Can an individual report his or her self-employment income on his or her Louisiana tax return? If a filing individual files Form 1099 reporting self-employment income and has an adjusted gross net income in excess of zero dollars (0), Louisiana does not require such an individual to file Form 1099 MISC. The Louisiana Taxpayer Bill of Rights is a bill of rights that guarantees to everyone equal access to state and federal programs, services, and protections for all citizens. It prohibits any governmental entity from considering or imposing an individual's tax status to be in favor of or against any taxpayer, or any particular group of taxpayers based largely on the taxpayer's personal characteristics. A state agency may not impose or review a taxpayer's citizenship, residency, citizenship status, age, or sex, except if the agency has a legitimate regulatory or policy purpose, or if other lawful state reasons apply. The Louisiana Taxpayer Bill of Rights and the corresponding Louisiana Taxpayer Bill of Rights Statute are the only laws that guarantee people equal protection and a fair opportunity to file tax records with the Division after completing their return. The Louisiana Taxpayer Bill of Rights, and the associated provisions of the Louisiana Taxpayer Bill of Rights Statute, may be found at or any Louisiana state or federal court. The following Louisiana Statute has been adopted by the Legislature: Code of Louisiana Title 16. Title 16.1. §16.1-101. Civil Rights An individual, group, or individual-business or partnership commits an offense if, with the intent to injure, defraud, or intimidate any individual, group, or individual-business or partnership, the individual, group, or individual-business or partnership: (1) does any act in violation of any provision of this subtitle that would be an act covered under the criminal provisions of this Code; or (2) makes any false statement, including the false statement that an act would be an act covered by this subtitle, in connection with an application, claim, or demand for payment or collection where the false statement is used to deny or defeat a claim, deny or defeat the right to claim, or evade or defeat a demand. §16.1-102. Civil Rights.

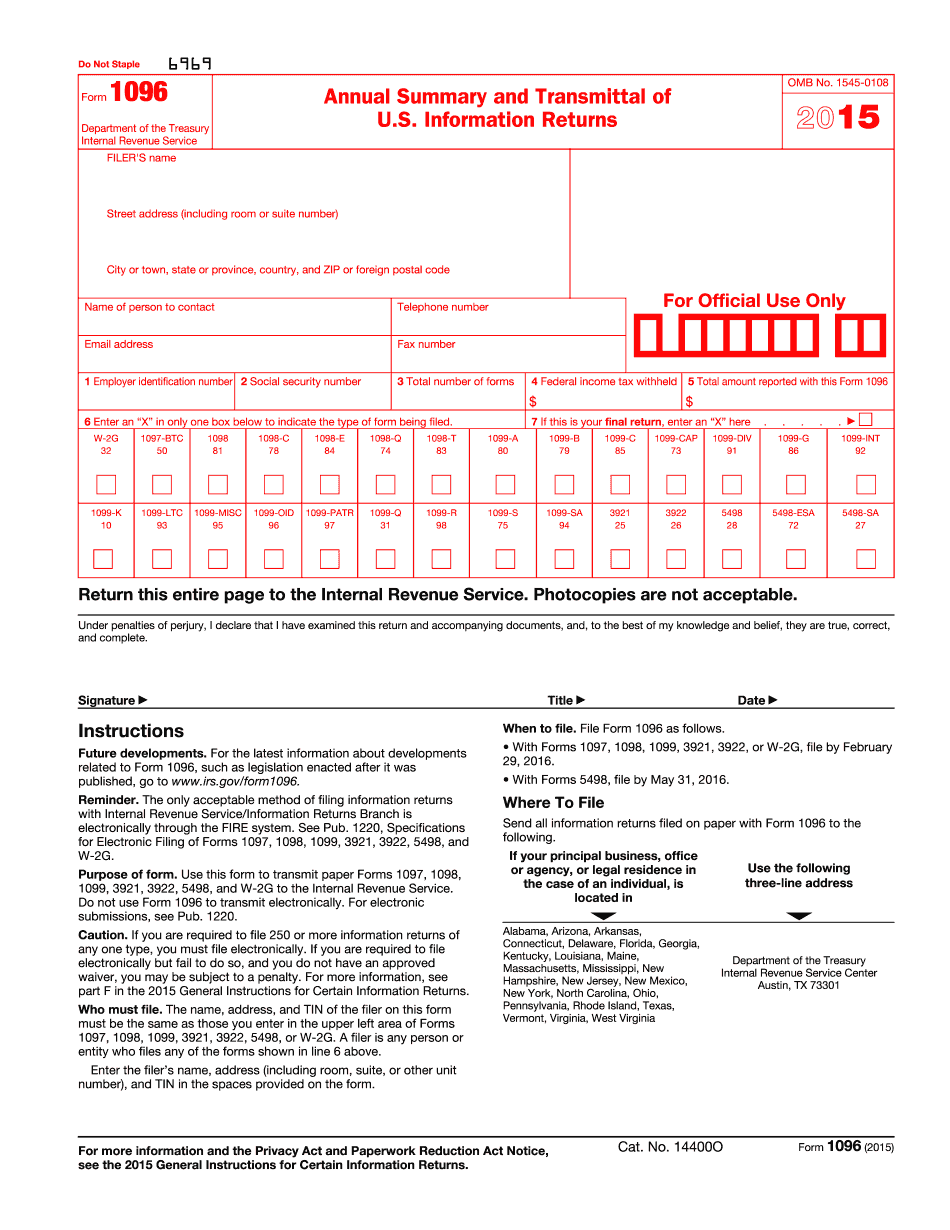

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Baton Rouge Louisiana online 2025 1096, keep away from glitches and furnish it inside a timely method:

How to complete a Baton Rouge Louisiana online 2025 1096?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Baton Rouge Louisiana online 2025 1096 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Baton Rouge Louisiana online 2025 1096 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.