Award-winning PDF software

2022 IRS 1096 for Contra Costa California: What You Should Know

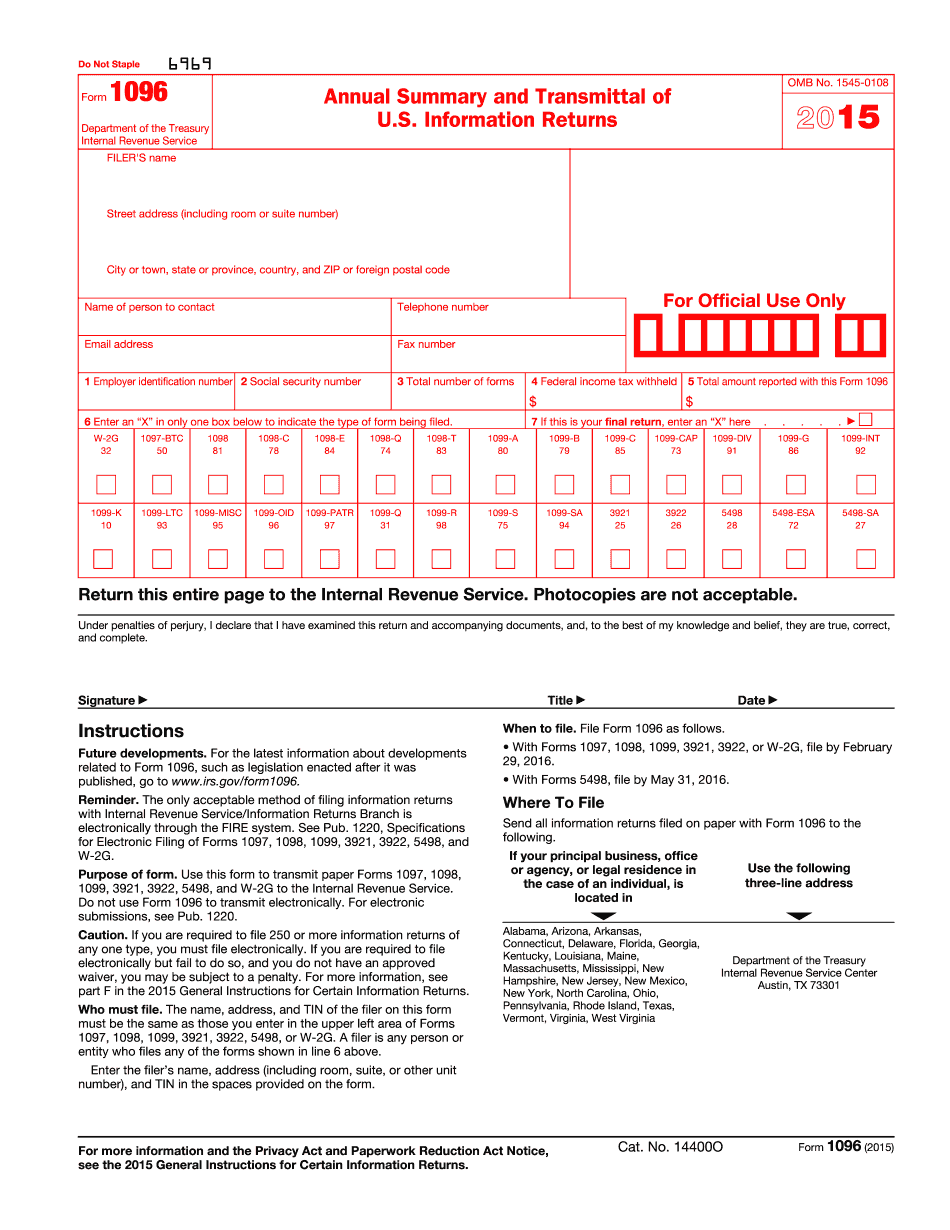

To file electronically, send Form 1096 to the address shown below. To receive Form 1096 by e-mail, use the following email address. For other e-mail addresses, please use the IRS e-mail contact form: I am an individual who files quarterly estimated tax (ETT) using an account number assigned by the company I own. For some reason, the company I am paying for my EMT pays an incorrect tax withhold by mistake (I get the wrong tax withheld by mistake but still owe my employer the wrong amount of money for the year). If my employer owes me the wrong amount of money for the year, and you owe me the right amount, I believe I can be sued by the company. Because I pay my company my monthly EMT bills, then can the company take my money if I file my return early, right? If not, I need to know, will there be an IRS audit of my company? The company I am working for also has a customer who uses a homemade system to file an EMT return. When I try to contact the customer, the customer responds with: “We don't have a website” ... “the only way you can get back to us is by calling.” Is there a website that I can visit and see if my refund check has been forwarded to the right account? When I try to visit my refund page, I learn it is not working, when I click on 'my refund' I learn: “Please note that the Refund Payment Program, which automatically issues refunds in the amount of the overpayment, is only available within the US. If you pay by check, the payment will be held by the financial institution (bank) until you mail a copy of your refund check.” There should be a website that says if you pay by check, it is held until the actual refund clears. I would like to notify my employer of my EMT business, and have my employer send me a check for the correct amount from the EMT account that I set up that pays for my EMT business. My employer is not doing the right thing in sending me the wrong amount of money for my EMT business. I would like to send the correct amount of money to my business account. I would like to check with my spouse. The form I filed on behalf of my spouse was returned as incomplete. The required information was missing when I filed the return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete 2025 1096 for Contra Costa California, keep away from glitches and furnish it inside a timely method:

How to complete a 2025 1096 for Contra Costa California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your 2025 1096 for Contra Costa California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your 2025 1096 for Contra Costa California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.