Award-winning PDF software

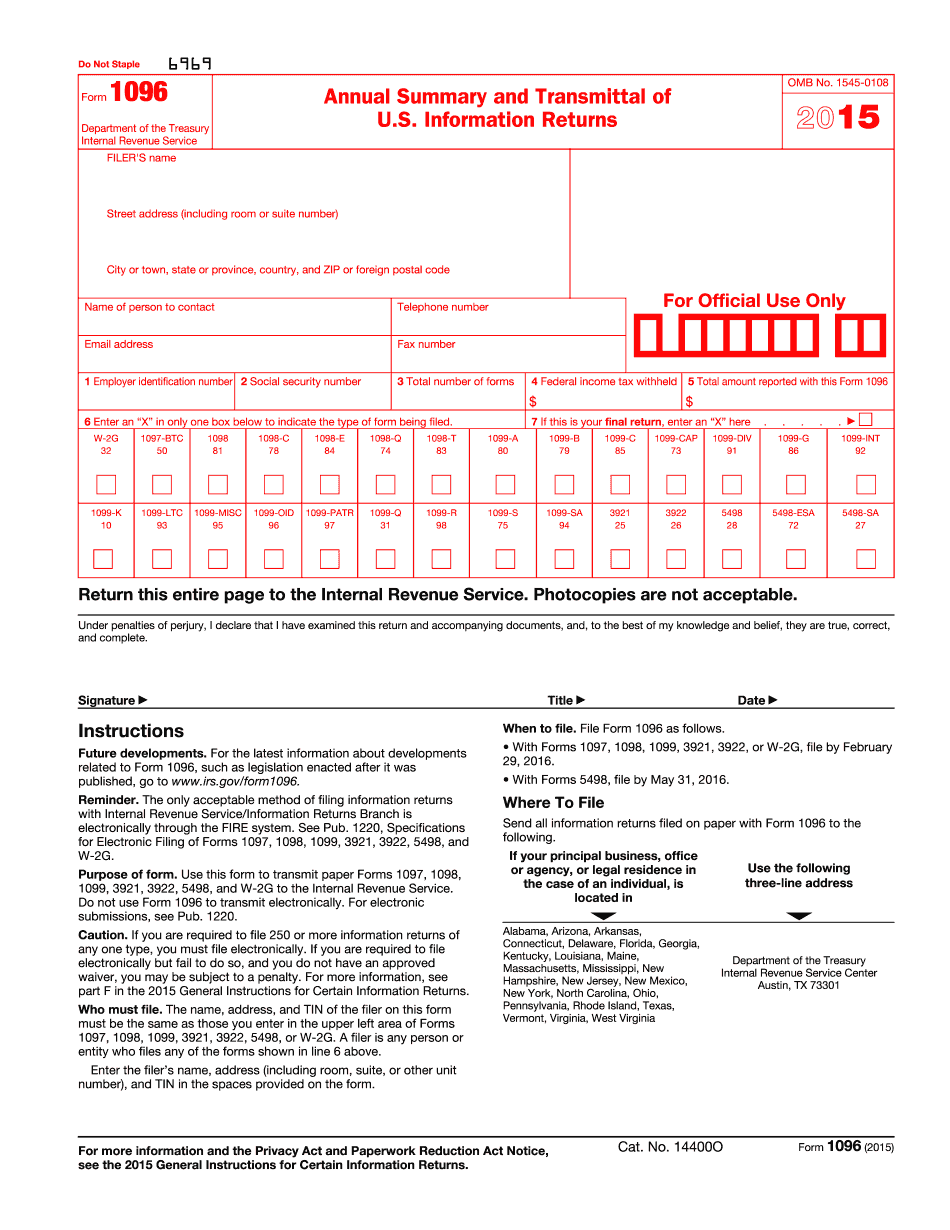

Cook Illinois 2025 IRS 1096: What You Should Know

Form 1096 • Form 1099. IRS The new 2025 Illinois sales tax rate of 2.50% applies to all non-food items unless exempted. Taxes are not applied on the sale or exchange of food and medicine. A list of items for sale at your dispensary with a tax stamp can be found at or by visiting a Tax Stamp Issuing Location. The following items are subject to the 2.50% sales tax: Personal Property — 4,500.00 with a tax stamp; 2,000.00 without a tax stamp. For the sale or exchange of 4,500.00 or more. Household Furniture — 1,500.00 with a tax stamp; 750.00 without a tax stamp. For the sale or exchange of 1,500.00 or more. Automobile — Leaving it on the side steps while you go to the restroom can result in a tax stamp being issued for the sale or exchange of that automobile. Automobiles are tax-exempt during seasonal periods beginning at least 30 days prior to the expiration of the exemption. Tax stamps for the sale are not given for the sale or exchange of automobile parts, equipment, or parts and labor. Peddling or distributing marijuana, hashish, Sylvia, or edibles is not subject to tax. If in doubt, consult the Illinois Alcohol and Tobacco Tax and Trade Bureau for more information. H.B. 35, House Bill 35, was enacted on August 27, 2017, changing how cannabis is taxed. The new law will allow the use of tax stamps once for cultivation of up to 16 plants at a time. Tax stamps are not required for the sale, exchange, or transfer of cannabis. These changes took effect July 5, 2017. Taxable Marijuana Products Under the New Illinois Medical Marijuana Law The sale and sale of marijuana to adults 21 and older is legal under state law. These sales and sales of marijuana products under state law are the subject of the new Illinois Medical Marijuana Law (Ill. Comp. Stat. 5/23-21 et seq. , and 5/23-29. The Illinois Department of Public Health is responsible for regulating the medical cannabis industry in Illinois. The Illinois Department of Public Health has updated medical cannabis laws to include regulations related to the issuance of medical cannabis product tax stamps. The new law is effective July 1, 2017.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Cook Illinois 2025 1096, keep away from glitches and furnish it inside a timely method:

How to complete a Cook Illinois 2025 1096?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Cook Illinois 2025 1096 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Cook Illinois 2025 1096 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.