Award-winning PDF software

2022 IRS 1096 North Carolina: What You Should Know

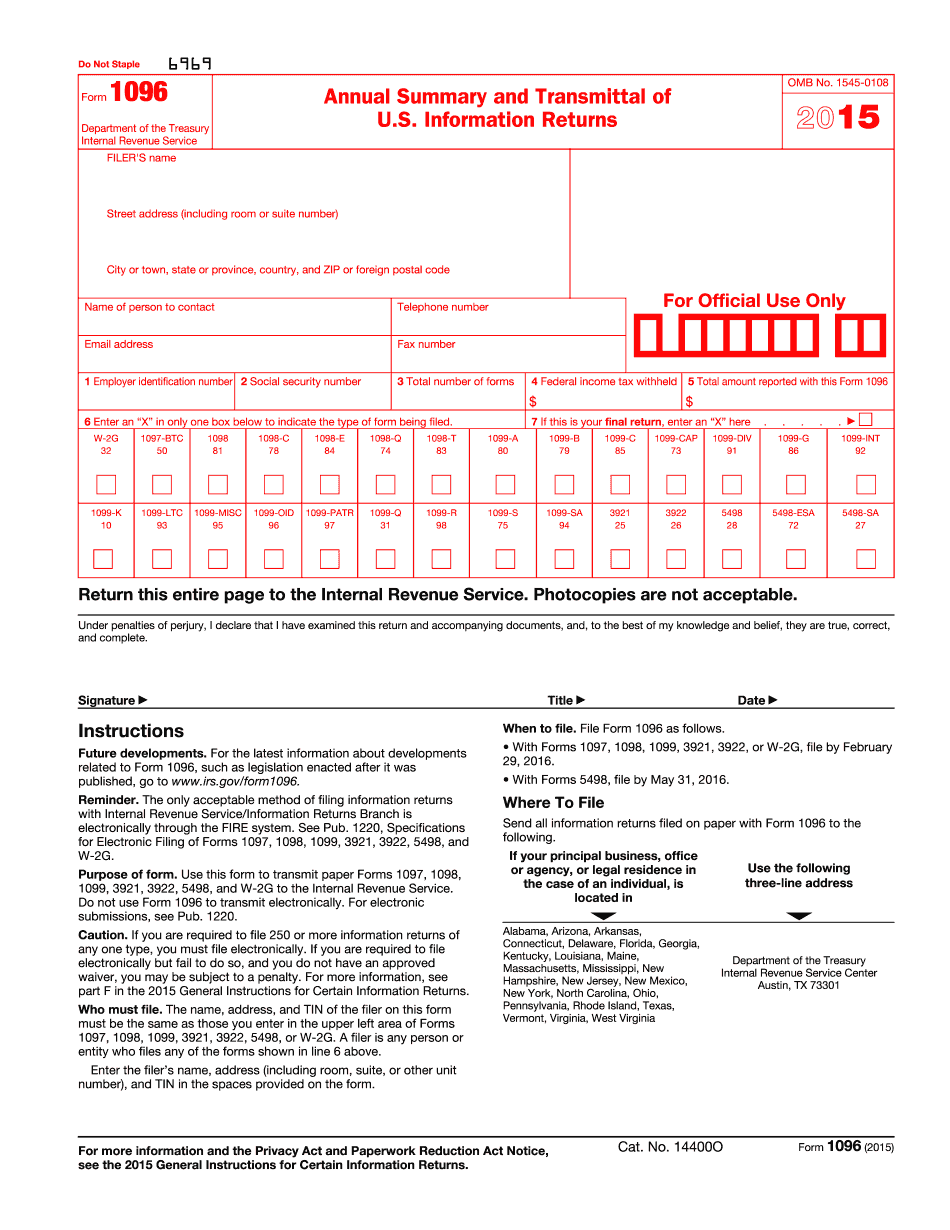

The new IRS Submission Processing Center located at: 1097-S-101 — IRS File a new Form 1096 with Form 1097. 2/2017 (1077) Form 1097-S-401 — IRS You must complete this if you don't receive a Form 1096 in your box. A copy of the original W-2, or if you did not receive Form 1096, a copy of Form 1097 with correct box references must be included. If the information you report on this form is different from you have reported on an earlier Form 1096, you must correct the information in the earlier Form 1096. See the 2025 IRS Tax Guide and Form 1096 instructions to see if your tax return was filed. 1098-B — Tax Information Statement If you report an item on your tax return other than a Form 1099 and your correct box or lines are filled out correctly on a previous 1098-B, there are two possible things that can go wrong. One has occurred to me so far that it might be hard to explain, the other seems just like a mistake a consumer might make, but in a few cases the IRS believes it is deliberate fraud. The IRS has determined that: Some mistakes on a previous 1098-B are intentional, meaning they are made to deliberately get you to file a false tax return or to cheat the government. In other cases, the mistake is just an honest mistake — such as the incorrect tax code or the improper use of a taxpayer ID number. Taxpayers who make deliberate and improper mistakes on a previous 1098-B may be subject to a late filing penalty, additional interest, and possibly criminal prosecution. See this blog post for more information on 1098-B penalties and penalties. 1098-G — General Instructions for Certain Information Returns— If you are filing a paper return with a Form 1098-G, a few things can happen even if you are sure about the right box or lines. If you fill out box 2 or 5 correctly (which is always the case), and you received a 1098-EIN and an ID Number on the 1098-G, you are a “Cone-Sized taxpayer” — a small, closely held business that is subject to a much lower tax rate (currently 15 percent for most small businesses).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete 2025 1096 North Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a 2025 1096 North Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your 2025 1096 North Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your 2025 1096 North Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.