Hey guys, so you're probably wondering where exactly you're supposed to find this 1099 form that is pissing you off because it's so annoying and it's really frustrating every year. It's a great question, first of all. The answer is the free version of it or the free wave getting it issue of the IRS directly. You know they're putting through all this hell, so it's their job to really kind of help you somehow. So they give you the form for free and then we'll ship it to you, actually. The way to do that is if you go to irs.gov and you can go to the tax form section, they'll give it to you. But the easier way to get it is actually to go to type in tax forms and then the first link you click on will take you there. Type in 1099 miscellaneous and then there you can find a link to the 1099. But remember, the PDF does not work, it is illegal to use it. Why? Because you'll be charged penalties fifty bucks a pop for each 1099 you send. The way to do it is you go to that PDF and you click on the link there inside the PDF that will take you to another website. In this website is a request page. You can ask for as many 1099s or forms that you need, just remember that when you ask for the 1099, you don't just ask for 1099, you also ask for the ten ninety-six, which is the annual summer report for all of your 1099. Okay, so make sure you don't forget either or. And also, please order extras, like whatever you think you need or two more. Not too much, but just like let's say extra twenty...

Award-winning PDF software

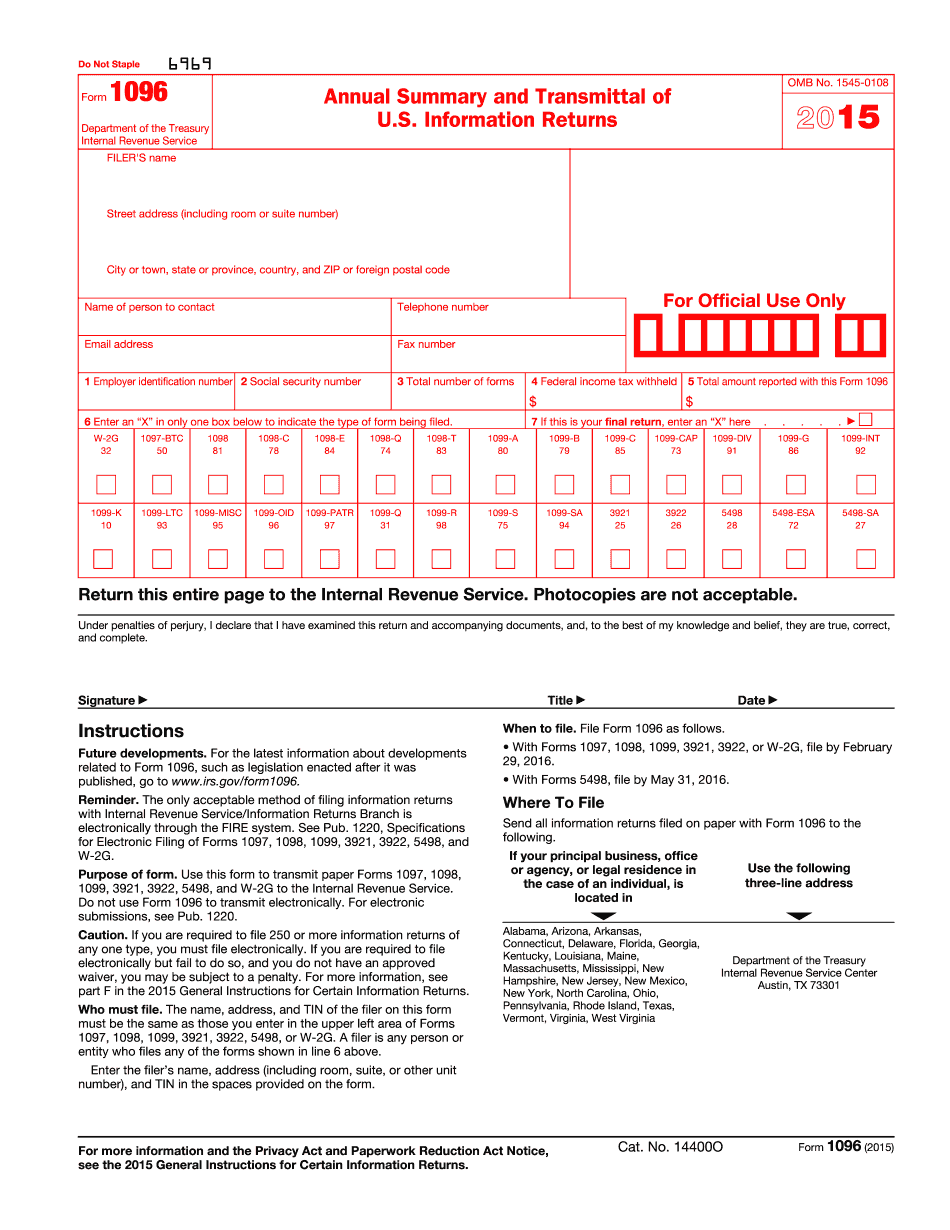

Where can i get a 1096 tax Form: What You Should Know

Fulfilled via USPS Priority Mail, 1st Class Mail, or 2nd Class Mail: 1096-A — All Others. 1096-C- All others. The form is scanned in the same manner as the 1096-A form. 1096-S — Annual Summary and Transmittal of U.S. Information Returns. Use this free form to summarize all 1099, 1098, 5498, and W-2G information. Fulfilled via USPS Priority Mail, 1st Class Mail, or 2nd Class Mail: 1096-A — All Other 1096-S — Annual Summary and Transmittal of U.S. Information Returns. The form is scanned in the same manner as the 1096-A form. 1096-S — Annual Summary and Transmittal of U.S. Information Returns. The form is scanned in the same manner as the 1096-S form. 1096-T — Tax Return Information. Use this free Form 1096 to summarize 1099, 1098, and W-2G information. Fulfilled via USPS Priority Mail, 1st Class Mail, or 2nd Class Mail: 1066 Form 1086 with Return (1040X) This form is used to report information relating to a return, statement, statement summary, or return information. It is filed within the Tax Year that the return is presented. 1066 Tax Returns. Form 1086: Free 1066 Form 1066 with Return (1040X). 1066 Form 1086 with Return (1040X). 1066 Form 1086 with Return (1040X). 1066 — Annual Summary of U.S. Information Returns. All other Forms 1096 are used to summarize 1099, 1098, and W-2G information. Form 1066 with Return (1040X) Free 1066 Form 1066 with Return (1040X). 1066 Form 1066 with Return (1040X). 1066 — Annual Summary of U.S. Information Returns. All other Forms 1096 are used to summarize 1099, 1098, and W-2G information. Form 1066 with Return (1040X). 1066-A — All Others. 1066-F — Statement of Computation of Earnings. The form is scanned in the same manner as the 1066-A version. 1066-S — Statement of Computation of Earnings.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 IRS 1096, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 IRS 1096 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 IRS 1096 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 IRS 1096 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Where can i get a 1096 tax form