Award-winning PDF software

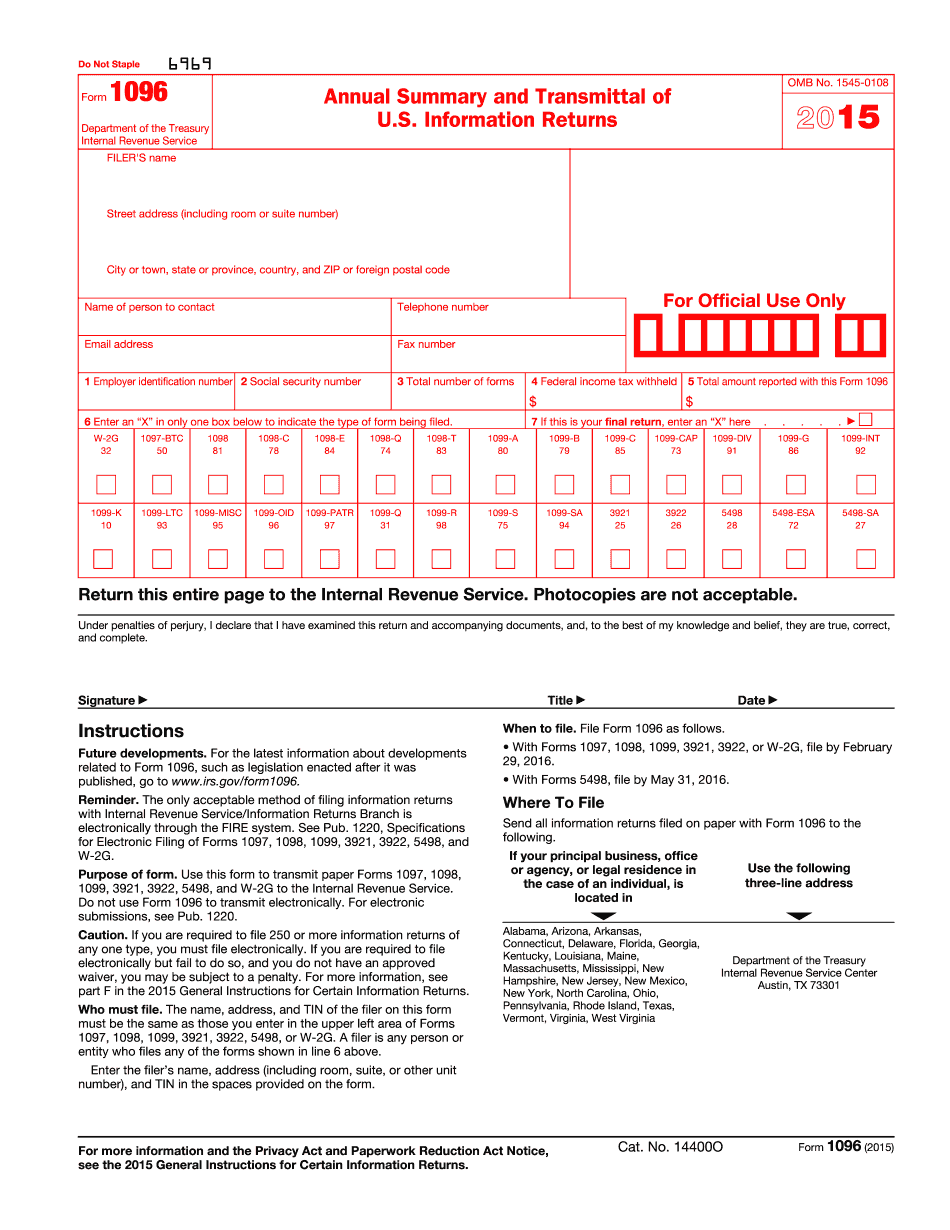

About Form 1096, Annual Summary And Transmittal Of Us: What You Should Know

Why Is IRS Form 1096 Called “Annual Summary and Transmittal of U.S. Information Returns”? Annual Summary and Transmittal of U.S. Information Returns (Form 1096) is in the United States Code (U.S.C.) [PDF]. In the U.S. Code, the term “Annual Summary and Transmittal of U.S. Information Returns” is a common tax code name and means:1) annual summaries of all returns filed with the Internal Revenue Service in each year;2) general summaries of the reports filed under sections 6011 to 6304, and section 6211 of title 26; and3) general summaries of all tax advice and assistance provided by the IRS. The form was last amended on May 23, 2018, by Pub. L. 104-191 — 76 Stat. 957. Form 1096 Tax Benefits: Benefits of Form 1096 If your household reported over 1,400 on their tax return in 2015, this could help you avoid or reduce the amount that you will be required to pay in income taxes: You do not have to pay a penalty (which could be as high as 27.6%!) if you have to file Form 1040 as a nonresident alien, filing only Schedule A. You may reduce your federal income tax liability for any year due to one of the following reasons: If you filed a joint return and you or your spouse has the same or higher adjusted gross income (100,000 for married couples filing a joint return with one head of household) and your spouse's AGI does not exceed your AGI: You do not have to pay the alternative minimum tax (AMT) and/or the Social Security portion of the Medicare tax. If you did not have to file a federal tax return for any tax year even if your AGI is lower than the federal income tax filing limit: You do not have to pay FICA wages income tax. If your family had 10,000 or more in net investment income: You may be able to exclude or reduce this exclusion, so you do not have to pay FICA wages income tax. If your adjusted gross income (AGI) was over the AGI limit of 200,000 or 100,000 for married couples filing joint returns with no head of household: You will pay the standard income tax rate of 20 percent (25.3%.

Online systems assist you to to arrange your doc management and boost the productiveness within your workflow. Stick to the fast tutorial so as to finished About Form 1096, Annual Summary and Transmittal of US, stay clear of mistakes and furnish it inside a timely fashion:

How to finish a About Form 1096, Annual Summary and Transmittal of US internet:

- On the website with the form, click Commence Now and pass to your editor.

- Use the clues to complete the relevant fields.

- Include your personal knowledge and speak to details.

- Make convinced that you choose to enter correct data and quantities in applicable fields.

- Carefully examine the content material from the kind at the same time as grammar and spelling.

- Refer to help you segment if you have any problems or tackle our Aid workforce.

- Put an digital signature on your About Form 1096, Annual Summary and Transmittal of US together with the guidance of Signal Device.

- Once the shape is completed, press Executed.

- Distribute the completely ready type through e mail or fax, print it out or help save on your equipment.

PDF editor lets you to definitely make improvements to the About Form 1096, Annual Summary and Transmittal of US from any world-wide-web linked device, customise it as outlined by your requirements, sign it electronically and distribute in different techniques.