Award-winning PDF software

Irs Form 1096 Instructions: How And When To File It - Nerdwallet: What You Should Know

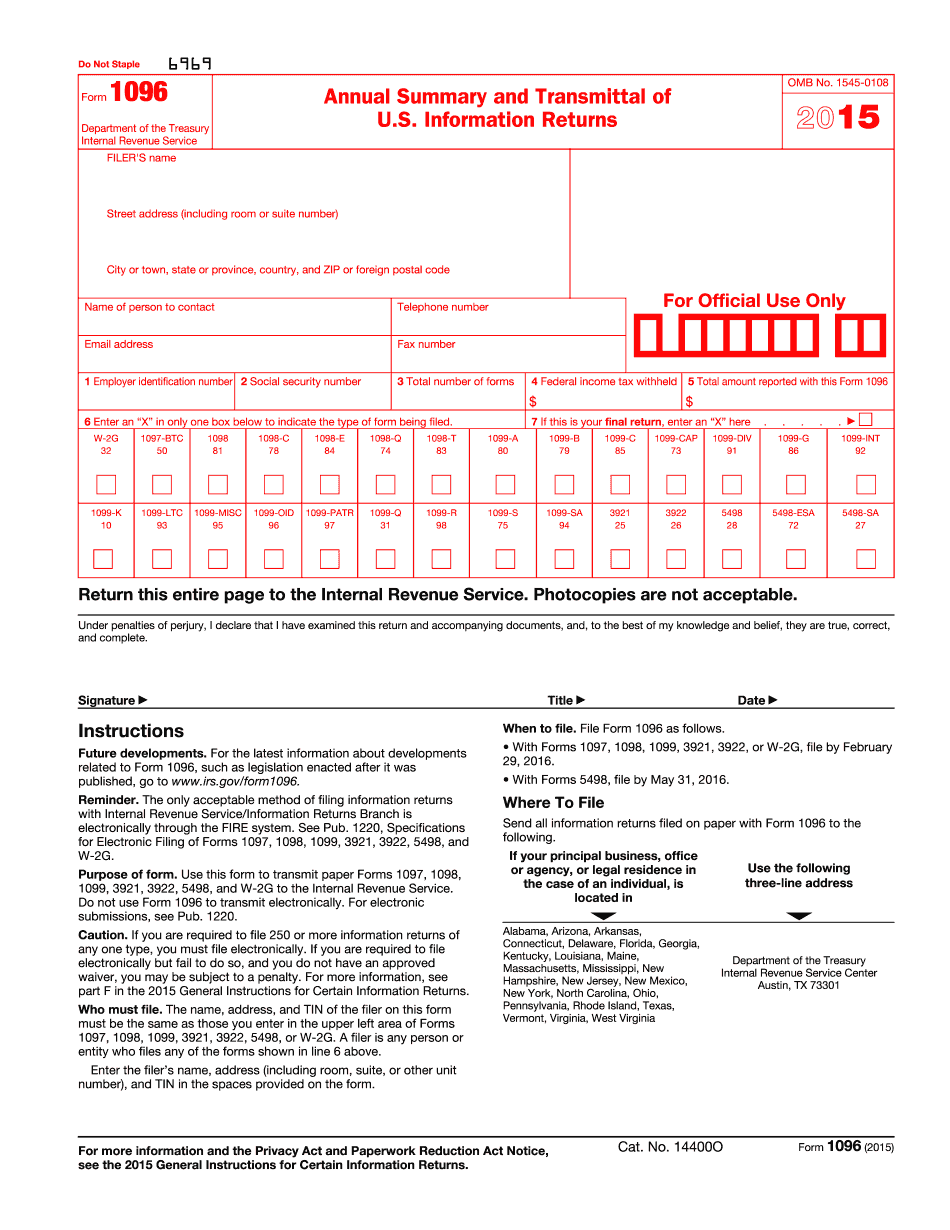

Form 1096 is still effective as of Jan 31, 2019. Please read the following information. The first page of Form 1096 states the filer is a “self-employed individual,” which means any businesses a sole proprietor, partnership or registered limited liability company is, regardless of the number of employees. Any taxpayer that owns more than 50,000 worth of tangible personal property at the end of the tax year must list themselves as a “self-employed individual,” and the taxpayer's personal exemptions and the value of all other exemptions listed for the tax year. For each business, report gross receipts, net profits, losses and gross income. If a taxpayer reports themselves as an owner of more than one business, report only the one that the person is actually involved in. A business owner's personal exemptions that do not qualify the business owner for the standard deduction should be reported on every Form 1099. If an owner of more than one business is listed on Form 1096, you must either list the business with your personal exemptions (if the business allows you to deduct expenses), pay additional taxes (if the business allows you to deduct expenses), or report your personal exemptions and pay the additional taxes. If the taxpayers does not list a business, they must report personal income, deductions and exemptions on the Form 1096. Form 2053 — Reporting of Employer-Provided Health Insurance Coverage (EIN): IRS This is for businesses who provide their employees with health insurance coverage through an employer-sponsored plan. They must report on Form 2053 both the total amount of health insurance premiums covered by the plan, and the amount paid by the employer with your own individual premium, including all income. Form 1096, Annual Summary and Transmittal of Income and Taxes, is for business owners who file electronically. Form 1096, Annual Summary and Transmittal of Income, Taxes and Employer-Provided Health Insurance Coverage: IRS The form is for businesses that file electronically. However, it can also be used for business owners who file paper Form 1096, as long as the paper is scanned or printed using the IRS' new Secure Upload feature. Form 1096 is for businesses that file electronically. However, it can also be used for business owners who file paper Form 1096, as long as the paper is scanned or printed using the IRS' new Secure Upload feature. This form is only for individuals who file electronically.

Online alternatives assist you to to organize your document management and enhance the efficiency of one's workflow. Abide by the short handbook so as to finish IRS Form 1096 Instructions: How and When to File It - NerdWallet, stay clear of problems and furnish it within a timely fashion:

How to finish a IRS Form 1096 Instructions: How and When to File It - NerdWallet internet:

- On the web site with all the form, click on Start out Now and go for the editor.

- Use the clues to fill out the suitable fields.

- Include your personal material and call details.

- Make confident that you just enter accurate information and figures in acceptable fields.

- Carefully check out the information belonging to the variety in the process as grammar and spelling.

- Refer to aid part if you have any issues or tackle our Assistance crew.

- Put an electronic signature on your IRS Form 1096 Instructions: How and When to File It - NerdWallet together with the aid of Sign Instrument.

- Once the shape is completed, press Accomplished.

- Distribute the ready variety through email or fax, print it out or help save on the equipment.

PDF editor lets you to definitely make adjustments towards your IRS Form 1096 Instructions: How and When to File It - NerdWallet from any net connected product, customise it as per your preferences, signal it electronically and distribute in several techniques.