Award-winning PDF software

f1096--2015.pdf - internal revenue service

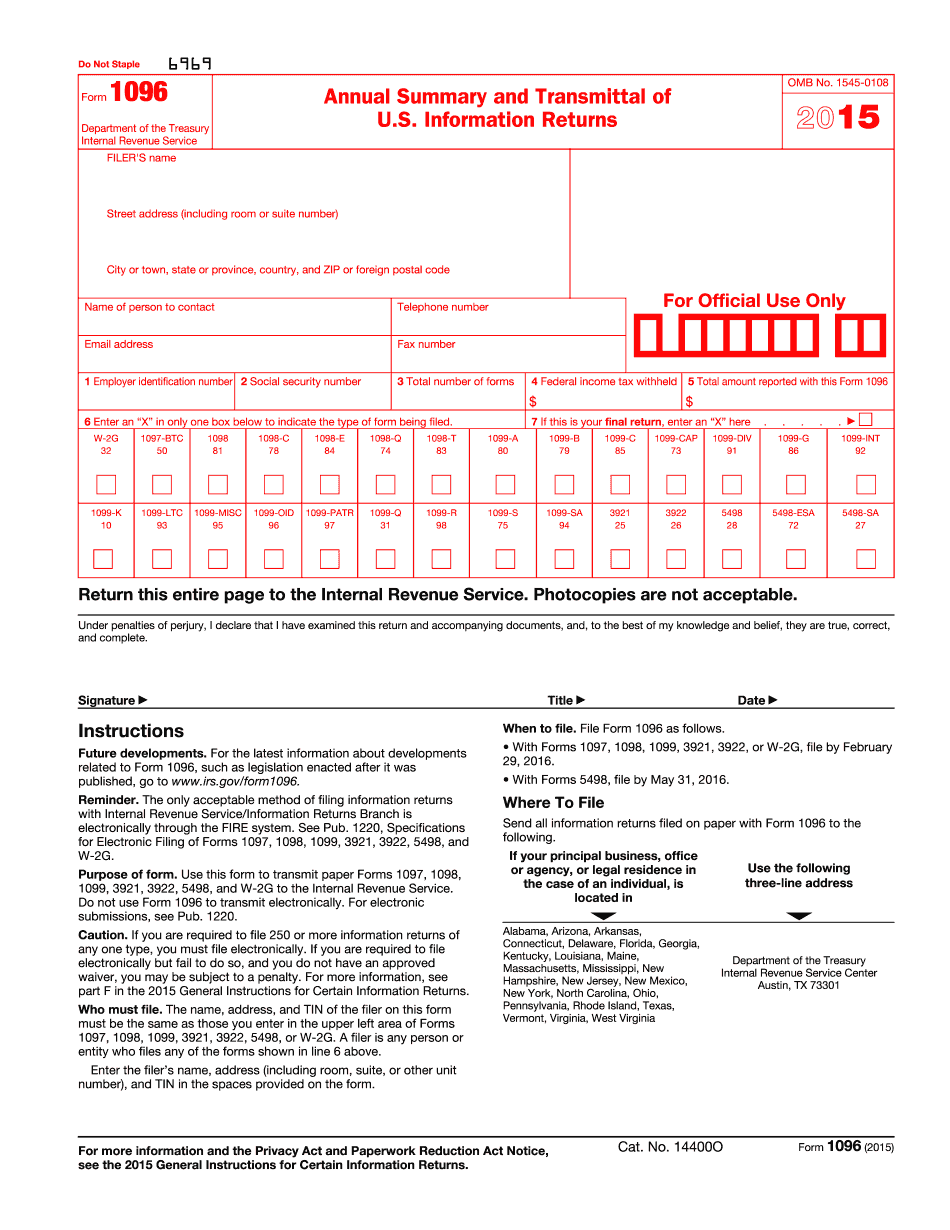

Forms 1096 and 1097 also can't be submitted to the IRS via e-mail. Please send form 1096 and/or Form 1097 to the following address: Internal Revenue Service The Internal Revenue Service, Box 65780, Washington, DC 20 Do not apply for a new social security number. It will help us reduce fraud. Your Social Security number is important for us to know who you are. It's especially important to know if there are any changes in your situation. This helps us protect the tax system. If you don't want us to know your new situation, we want to know. But this also means that if we need to collect your taxes, we'll know how you ended up without a social security number. If you have a Social Security number, we'll be able to determine: The name and address of your employer; Who you got your Social Security wage stubs from; What they.

Prior year products - internal revenue service

The IRS provides the information on their website by tax year, but you will need to check your own year-to-year tax filings for all applicable income information – this info is not available in a downloadable PDF file on the IRS website. Here is a copy of the tax filing form that I filed for 2015, which is the 2016 return if you prefer: 2015 Form 1095 (PDF). Click on my filer ID below, then “2015” (not “2016”). If you are on Twitter or Facebook you can follow me and/or the IRS_Newsgroup. 2016 Form 1040A (PDF) 2016 Form 1040EZ (PDF) 2016 Form 1041-S (PDF) Here's a summary of what you'll get if the 2016 tax year has already been entered on your 2015 or 2016 forms; this is a quick summary so be sure to read the entire form with caution: The information you get is: Annual income for all years, net interest expense, and.

2015 form 1099-misc - internal revenue service

Statement. See PDF for printer-friendly version Form 1095 – Return of Tax Withholding to the Internal Revenue Service (for taxpayers who must file electronic returns) In the following circumstances, you are not required to file Form 1040 (tax return) or Form 1040NR or 1040NR-EZ: You pay any federal income tax to the Internal Revenue Service voluntarily. This means that you did not pay the tax to the IRS. You are exempt from paying any federal income tax due to being disabled or a widow (or widower if you file a joint return); or Income subject to tax is earned or received from a foreign employer. You may have to file Form 1040 when you receive or expect to receive a Social Security number. See Publication 501 of the Internal Revenue Code, as amended. The Social Security number is required if you receive or expect to receive either of the following: Social Security Income (SSI, SDI,.

attention filers of form 1096: - internal revenue service

PDF file is in PDF format and will not show as the first tab. The official .pdf file is in PDF format and will not show as the first tab. For the information provided, if you are filing a Form 1096, include this section at the bottom of the form, if not, then I would suggest you not include it in the PDF file.

2015 general instructions for certain information returns - internal

Are not exempt from backup withholding for this purpose, you would be subject to backup withholding under section 6011 if the taxpayer failed to include the information on Forms 1099 (or 1098 for certain filers) or W2G (or report any form 1099-MISC) at all. You can correct this by entering the correct information in box 1 of Form 1096. Do not enter zero. You're reporting backup withholding will not be affected unless you . Are subject to backup withholding. As part of your preparation, we suggest that you check to see if your exempt status would allow you to exclude this backup withholding. We have included an example of this below the Form 1096 instructions. Do you have questions? If you require further information, you can contact us by calling. You may want to read our “FAQs on Tax Tip 2014-07” for additional information on backup withholding. — Government.